Bitcoin: A financial system for the internet era

Bitcoin has seized the opportunity to redefine and reimagine how a financial system can and should work in the Internet era. Photo courtesy of Getty Images.

Bitcoin has seized the opportunity to redefine and reimagine how a financial system can and should work in the Internet era. Photo courtesy of Getty Images.

Written by Shail Shah

A software developer called Satoshi Nakamoto is credited as the founder of the Bitcoin digital asset and payment system. Curiously, no one seems to have met him – leading to speculation that Satoshi Nakamoto may perhaps be an alias for one or several people. [At press time, Australian Craig Wright was revealed as Bitcoin creator Satoshi Nakamoto.]

Regardless of this intrigue, Bitcoin has seized the opportunity to redefine and reimagine how a financial system can and should work in the Internet era.

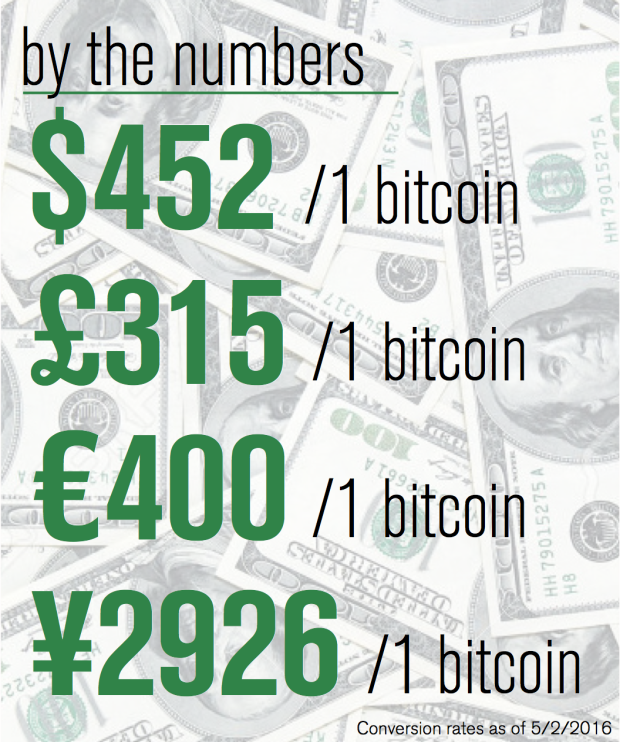

Bitcoin offers a peer-to-peer system where users can “transact” without any intermediaries. Once a transaction is requested, it is verified by network nodes and recorded in a public ledger known as The Block Chain. The conversion value of bitcoins depends completely on market forces (supply and demand), security (coding), and confidence (from consumers) with no government regulation.

The US Treasury categorizes bitcoins as decentralized virtual currency. Bitcoin has also spawned a new term: “cryptocurrency.”

Without a Central Bank issuing bitcoins, there are three principal ways to acquire them. One method is on an exchange, where buyers and sellers trade similar to a stock market. Bitcoins are also accepted online as payment for goods and services. Lastly, and most remarkably, this virtual currency can be created with a computer and a keyboard.

A key advantage to the Bitcoin system are its cheaper fees, lower than the typical 2-3% merchants pay for credit card transactions. It has proven to be a powerful force, attracting large numbers of people from all around the world into a modern, well-integrated economics system.

That said, a key disadvantage that’s putting pressure on Bitcoin’s survival is the reported use of its currency by terrorists and drug dealers. As money.com put it, bitcoins are “the currency of choice for people online buying drugs or other illicit activities.”

Many speculate that there is a finite number of Bitcoins – 21 million — that will ever be in circulation. Currently, more than 12 million reportedly are in reserve, meaning that nearly 9 million are in play, waiting to be coded out.

International remittance, money sent as a gift overseas, is one obviously huge market for Bitcoin growth.

According to the World Bank, about $400 billion annually is sent home by low-income employees working abroad. Banks and other service providers take up to 10% fees to transfer funds, far more costly than using bitcoins. Furthermore, as Marc Andreessen has written in The New York Times, only 20 countries have “what we would consider to be fully modern banking and payment systems; the other roughly 175 have a long way to go.”

At its best, Bitcoin virtual currency has the ability to act as a catalyst in the modern era in spreading the benefits to a contemporary economic system.

Photo courtesy of Getty Images.

Thank you for the post, you helped me a lot.